Frequently Asked Questions

SAVE & SPEND FAQs

How can I find an ATM to make a deposit?

Locate Allpoint and MoneyPass ATMs!

- These are ATMs that let you make free deposits and withdrawals!

- If you access Allpoint or MoneyPass from our website, it only provides ATMs available for free withdrawals.

- But if you go directly to moneypass.com or allpointnetwork.com, it gives you the ability to choose deposit-accepting ATM’s within your zip code!

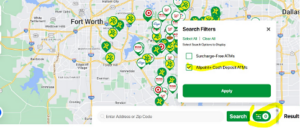

Allpointnetwork.com example:

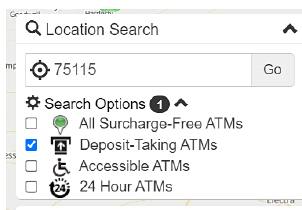

Moneypass.com example:

How do I get cash from my account?

Cash withdrawals can be made at any Allpoint or MoneyPass surcharge free ATMs. You can also visit a shared branch and provide the teller with your name, credit union name, member number and ID to make a withdrawal.

How do I get a large amount of cash from my account?

We can raise your card’s daily spending limit so you can make a large purchase, or you can wire funds to an external account. When we raise your card’s spending limit, you can also make large withdrawals from an ATM.

How do I deposit cash to my account?

Deposits can be made at deposit-accepting MoneyPass ATMs. A deposit can also be made by visiting a shared branch and providing them with your credit union name, your license, your member number and your account number.

How do I deposit a check to my account?

MoBi Anytime Deposit is the most convenient way to deposit your check. To use this service, log into your Southwest Financial mobile app and select deposit. Then, you’ll take a picture of the front and back of your check to deposit the funds. You can also make check deposits at deposit-accepting MoneyPass ATMs. Check deposits can also be made at a shared branch by providing them with your credit union name, your license, your member number and your account number to make a deposit.

How long is the hold on my MoBi Anytime Deposit?

The first three deposits are placed on hold for seven business days. After that, no hold is placed if you deposit the same type of check for a similar amount.

How do I get a cashier’s check payable to me or someone else?

Kayde – our 24-hour phone teller – responds to requests for cashier’s checks payable to yourself and it will be mailed to the address on file. You can also contact our Member Loyalty Team and request a cashier’s check payable to yourself be mailed to the address on file. Another option is to visit a shared branch and provide them with your credit union name, your license and your account number to request a cashier’s check payable to yourself or others.

What is the routing number?

Our routing number is 311079827.

Do you offer an account if I keep high balances in my checking account?

Yes, we have a High Yield Checking Account! For this account, you’ll need to:

- Opt in – there are no penalties but lots of rewards!

- Enroll in eStatements.

- Direct deposit your paycheck in your checking account.

- Have 15 signature-based debit card transactions of $10 or more.

- Pay at least one bill electronically through our Bill Pay.

Note: All checking accounts can receive direct deposits and are initially set up with overdraft protection (savings account funds covering an overdraft of your checking account). All checking accounts also qualify for free bill pay.

Courtesy Pay & Overdraft Protection FAQs

Do I have Overdraft Protection?

All our members with a checking account have their savings account as free overdraft protection.

Do I have Courtesy Pay?

You only have Courtesy Pay if you opted in when you submitted your application for the checking account.

What is the difference between Overdraft Protection and Courtesy Pay?

Overdraft Protection will cover an item that is presented for payment when the checking account available balance is not enough to cover the item but funds are available in your savings, Overdraft Protection will automatically transfer the money to your checking account to cover that item. There is no fee to have Courtesy Pay added to your account. You are only charged a fee if you exceed the available balance in your account and Courtesy Pay is used. When an item (check, ACH or everyday debit card transaction) is presented to us for payment and the funds are not available in your account, we will authorize the transaction up to your Courtesy Pay limit.

What is the fee to use Overdraft Protection?

It’s free! There is no fee to use Overdraft Protection.

What is the fee to use Courtesy Pay?

Courtesy Pay fees depend on the number of overdrawn transactions. The first two transactions are $1 each, the next ten are $30 each and anything after that is $35 each. The fee schedule starts over annually.

What are the requirements to use Courtesy Pay?

You must have a checking account with a deposit that clears up your deficit, preferably within a two-week period.

How do I opt in or out for Courtesy Pay for debit card and ATM transactions?

If you wish to opt in, we have a Courtesy Pay form you can complete. You can remove Courtesy Pay by verbally request after answering three ID verification questions or by submitting secure message.

Debit Card FAQs

How long does it take to receive a new debit card?

It takes seven to ten business days.

How do I activate my new card?

Call (800) 992-3808 to activate your card and set up your PIN.

How do I report my card lost or stolen?

Call us at (214) 630-7111 and speak with our Member Loyalty Team. For after hours please call (800) 472-3272.

When will I get my new card after it’s lost, stolen or renewed?

You will get your new card within seven to ten business days.

Can I turn my card on and off?

You can call our Member Loyalty Team to add a temporary or permanent restriction. By downloading the CardValet app, you have the option of temporarily blocking your card as well.

Are there transaction limits on my card?

Yes! The daily limit is $1,000 for pin-based transactions and $2,500 for credit-based transactions.

Do I need to notify the credit union that I will be using my card during travel?

Yes! Inform us whenever you leave the country to avoid any mistaken card deactivations.

Are there fees if I use my card outside of the US?

Yes! There are foreign transaction fees based on the merchant.

How do I dispute a transaction on my account?

Contact our Member Loyalty Team via phone at (214) 630-7111 or send us a secure message.

Are there different types of disputes?

Yes! There are two types of disputes. Fraud disputes are for unknown transactions. Regular disputes are for transactions you initiated but did not receive the product or service as promised.

When will I hear from someone regarding my dispute?

We will contact you with any updates or additional questions within five business days of the receipt of your dispute form.

How long will it take for me to get my money back on a dispute?

For fraudulent transactions, you will receive credit within five business days. For regular disputes, it may take 45 to 60 days to get a response from the merchant.

Can I dispute pending transactions?

No. Transactions must have posted to your account. This is because pending transactions sometimes fall off or post for a different amount.

Why was a company able to take money from my account when I placed a stop payment on them? (i.e. when a company takes a payment using your debit card after we placed an ACH stop payment.)

Stop payments must be placed for each type of payment method (ACH, debit card, etc.).

Shared Branching & ATM FAQs

What is a shared branch?

It’s a credit union that is affiliated with our shared branch network. Our members can use it to do teller transactions such as cash deposits, cash withdrawals and check requests.

How do I locate a shared branch?

Go to https://www.swfinancial.org/shared-branches and plug in your zip code.

What transactions can I perform at a shared branch?

You can make deposits, do withdrawals and request cashier’s checks.

Is there a fee to use a shared branch?

Yes. The fee is $3 per transaction.

What do I need to perform a shared branch transaction?

When you visit a shared branch, make sure you have your current ID, your credit union name and your member number. Temporary licenses are not accepted.

BORROW FAQs

How do I apply for an Auto Loan with Southwest Financial?

Apply online at https://internetloanapplication.cudl.com/swfinancial/. You can also contact us and apply by phone!

Do I need to choose a specific vehicle to apply?

You do not need to have chosen a specific vehicle to apply. We can submit the application for a general preapproval. However, it would be helpful to submit the vehicle information, payoff letter and insurance information for refinance requests.

Do I have to put money down?

There are several factors that go into our loan decisions and whether we require a down payment or not. If a down payment is required, your Member Opportunity Specialist will communicate this as a condition of your approval. If you do plan on having a down payment, it is always helpful for the credit union to know upfront.

How much will my payments be?

Your payment amounts will vary based on your situation. There are several factors taken into consideration when calculating payments. Those include: the amount financed, the interest rate, the term of the loan and payment frequency (weekly, biweekly, monthly, etc.).

Do I have a payment grace period?

If we receive your payment more than 14 days after the due date, we will charge you a late fee of 5% of the scheduled payment due with a minimum late fee of $15.00.

How much is the late fee?

The late fee is 5% of the scheduled payment due with a minimum late fee of $15.00.

What if I have my vehicle financed somewhere else?

We have been able to save members tons of money over the years by offering our Beat the Rate Financing option. You can apply online at here to see if we can save you money too.

Credit Card FAQs

When will I receive my credit card?

Once you sign and complete your credit card paperwork, you will receive your card in seven to ten business days.

What number do I call to activate my card?

Call (800) 992-3808 to activate your card and set up your PIN.

When are my payments due?

Your credit card payments are due on the 12th of each month. Please refer to your credit card statement for further information. If you signed up for eStatements, payment due dates can be found there.

How can I make my credit card payments?

Payments to your credit card can be made via online banking from one of your Southwest Financial accounts. You can also mail your payments or visit this page to pay online.

How do I report my credit card lost or stolen?

Call us at (214) 630-7111 and speak with our Member Loyalty Team. For after hours please call (800) 472-3272.

Do I have a grace period?

If we receive your payment more than 14 days after the due date, we will charge you a late fee of 5% of the scheduled payment due with a minimum late fee of $15.00.

How much is the late fee?

The late fee is 5% of the scheduled payment due with a minimum late fee of $15.00.

How do I dispute a transaction on my account?

Contact our Member Loyalty Team via phone at (214) 630-7111 or send us a secure message.

Are there different types of disputes?

Yes! There are two types of disputes. Fraud disputes are for unknown transactions. Regular disputes are for transactions you initiated but did not receive the product or service as promised.

When will I hear from someone regarding my dispute?

We will contact you with any updates or additional questions within five business days of the receipt of your dispute form.

How long will it take for me to get my money back on a dispute?

For fraudulent transactions, you will receive credit within five business days. For regular disputes, it may take 45 to 60 days to get a response from the merchant.

Can I dispute pending transactions?

No. Transactions must have posted to your account. This is because pending transactions sometimes fall off or post for a different amount.

Home Equity FAQs

What is a Home Equity Loan?

A Home Equity Loan is a loan secured against the equity in your home.

How do I know how much equity I have in my home?

Available equity is calculated by taking 80% of the home’s value and then deducting any existing mortgage balances.

Is there an application or origination fee?

No! Southwest Financial does not charge an application or origination fee.

What can a Home Equity loan be used for?

A Home Equity Loan can be used for a variety of purposes, such as debt consolidation, home improvements, vacations, college payments and more.

Can I take equity out of my home without refinancing my first mortgage?

Yes, absolutely! If you already have a first mortgage, then the Home Equity Loan would simply be done as a second lien.

How much will I have to pay in closing costs?

We currently cover closing costs for our members! The only exception would be if a full appraisal is needed to prove value.

What if my credit is not that great?

Don’t worry – we’ll still give you a chance! We will look at all aspects of the application, including relationship with the credit union, value of the home, previous payment history, job history and more.

Are your Home Equity Loan rates fixed, or do they change during the loan term?

All our Home Equity Loan rates are fixed and will not change throughout the loan term.

Is there a penalty for paying the loan off early?

There are no penalties for an early payoff, and you can make principle-only payments throughout the loan term.

How long does it take to receive a Home Equity Loan?

Once we receive the application and requested documentation, it only takes about two to three weeks.

How do I apply for a Home Equity Loan?

Apply online at https://www.swfinancial.org/home-equity-loans. Make sure to choose the appropriate box for your borrowing situation.

Personal Loans FAQs

(Signature, Steady Stash, Hassle-Free, Vacation, Holiday, Back to School)

What is a Personal Loan?

A personal loan is a type of loan that is not secured with collateral, such as a vehicle, home or account. It is an unsecured installment loan. You will still have fixed payments and a fixed interest rate.

How do I apply for a loan?

If you are interested in a personal loan, apply online at https://internetloanapplication.cudl.com/swfinancial/.

How long does it take to receive a decision on my application?

Our goal is to have an answer back to you within the same business day! However, this depends on the time you submitted your application and the number of applications received that day. If your application needs additional review, the timeframe may extend beyond a single business day.

How much can I apply for and what are the available terms?

The minimum amount for an unsecured loan is $500. The maximum amount is $15,000. Terms can range anywhere from 6 to 48 months. Upon approval, your Member Opportunity Specialist will discuss the options with you.

How long does it take to receive my personal loan funds?

Our goal is to have the loan booked and funds dispersed the same day we approved the loan. Of course, this depends on when we received your application and your completion of loan documentation.

Can I pay my loan off early?

Definitely! If you choose to pay off your loan early, there are no prepayment penalties or fees.

Do I qualify for a Hassle-Free Loan?

Please refer to the following webpage to determine if you qualify for a Hassle-Free Loan: https://www.swfinancial.org/hassle-free-loans.

Do I have a payment grace period?

If we receive your payment more than 14 days after the due date, we will charge you a late fee of 5% of the scheduled payment due with a minimum late fee of $15.00.

How much is the late fee?

The late fee is 5% of the scheduled payment due with a minimum late fee of $15.00.

Got More Questions? Text us at 214.613.0834